Last night, I had the privilege of joining the Xero team at Santa Monica New Tech, a group of entrepreneurs who get together to showcase new technology and network. I spoke a bit about what make’s Xero a great fit for U.S. startups looking for an accounting software solution. Here’s what I had to say.

How to upgrade your Shopify site to use Reponsive Checkout

Why you should pay your employees every week

If you're a business owner setting up payroll, you might be wondering, "How often should I pay my employees"? Twice a month and every two weeks are the most common. Just about everyone has worked a job where he or she got paid every other week. But that's not a good reason to stick with it. If given the choice, you should always choose every week. Here's why...

Did QB Connect Help Us Understand Intuit’s Strategy?

Great post from Randy Johnston interpreting Intuit's vision for online accounting from the presentation at QB Connect 2014.

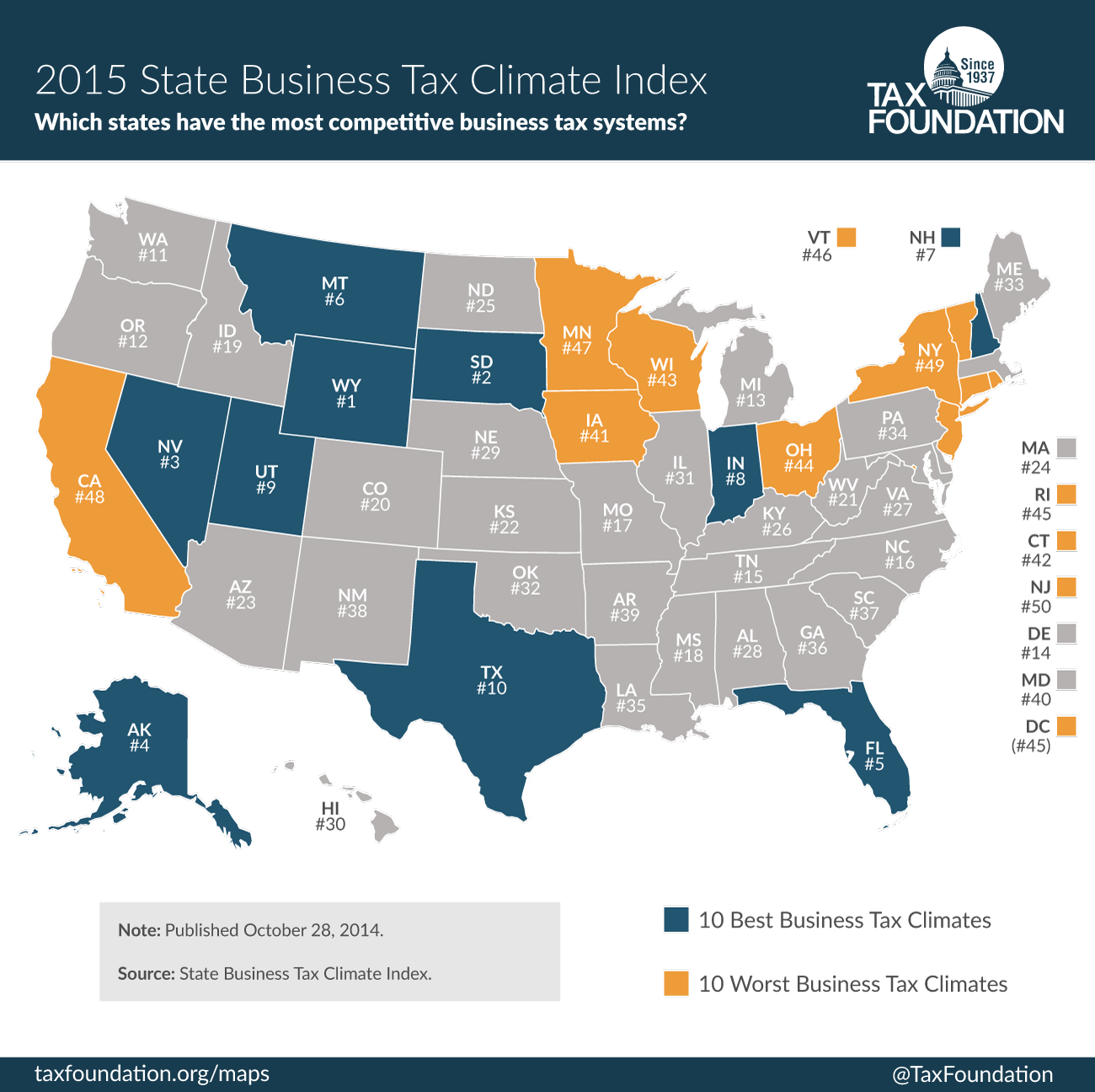

Best and worst states for business taxes in 2015

Harvard, MIT and $100,000 in Free Consulting

Xero + QBO share just 2% market penetration in U.S. accounting software [chart]

Shoeboxed ends integration with FreshBooks

Xero bug causes incorrect values in Executive Summary report

I recently discovered that Xero is displaying incorrect values for three key ratios in the Executive Summary report. The issue does not appear to be affecting all Xero accounts. To be safe, I recommend that all Xero advisors double-check the ratios in the Executive Summary report by exporting to Excel first before publishing PDF reports.

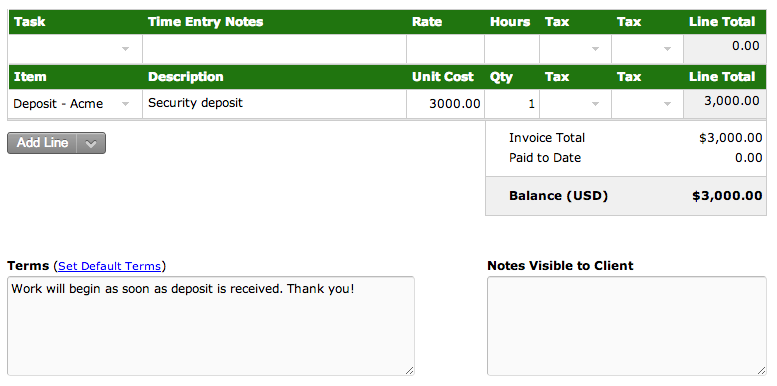

How to collect and track customer deposits in FreshBooks

One problem for FreshBooks users is that customers are unable to make partial payments when paying invoices online. This can make it difficult to keep track of deposits or advance payments from customers. Fortunately there are a few workarounds that make it relatively simple to bill for and keep track of these advance payments.

![Xero + QBO share just 2% market penetration in U.S. accounting software [chart]](https://images.squarespace-cdn.com/content/v1/5437534fe4b063c91fba5659/1413251404208-SE5IJABBENIXQBIHWWOX/image-asset.png)