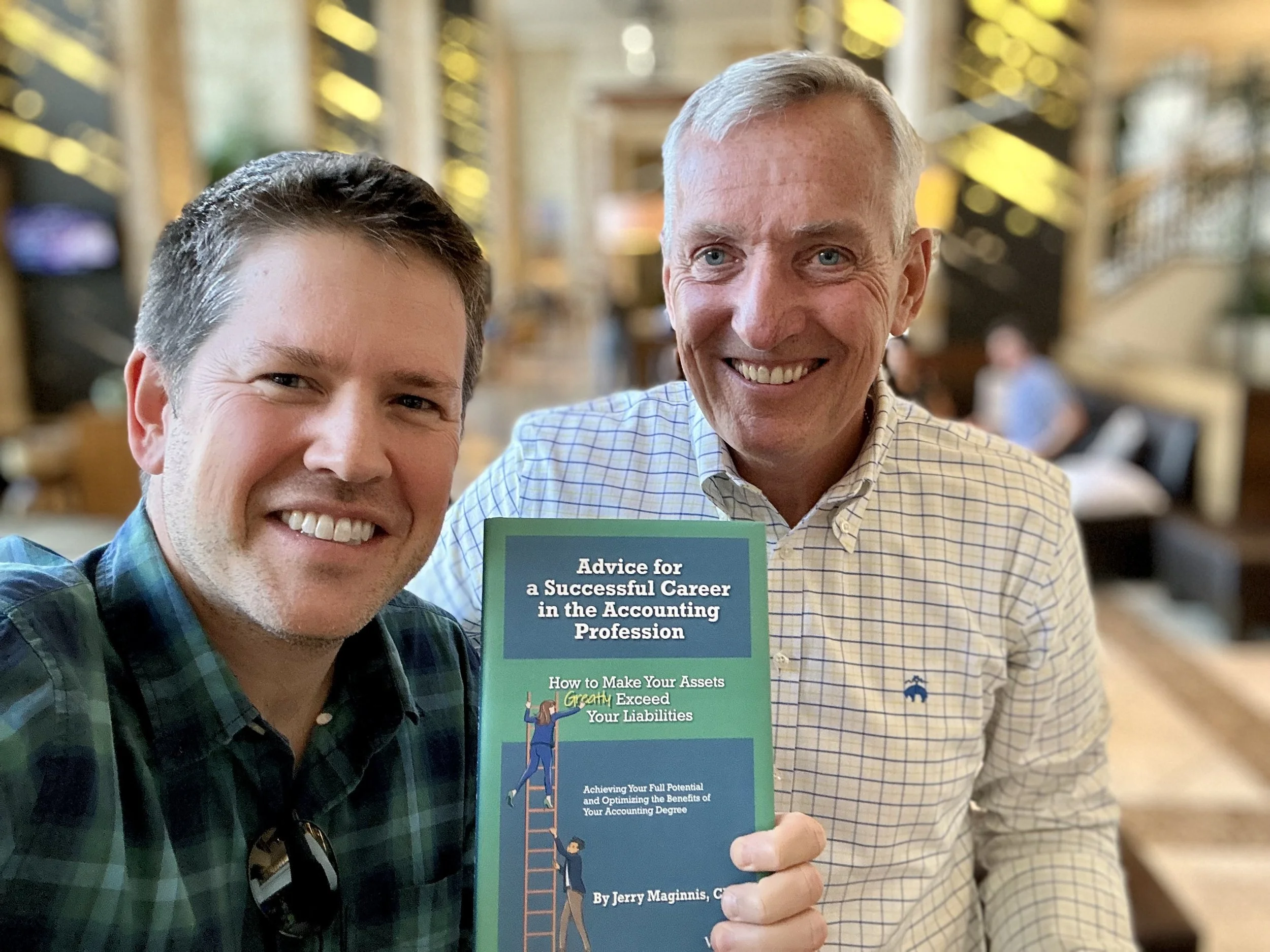

Follow Jerry Maginnis for Insights and Inspiration in Accounting

I had the pleasure of spending some quality time last night with Jerry Maginnis, a seasoned executive in the accounting field whose vast experience spans various leadership roles, including serving as the Office Managing Partner for KPMG's Philadelphia Office and now contributing to the success of organizations like Cohen & Steers Mutual Funds, inTEST Corporation, and Centri Business Consulting, LLC.

From Bookkeeper to Marketer: My Journey, Content Tips, and Tech Tools

Thanks, Meryl Johnston, for having me on the Lifestyle Accountant Show! As an entrepreneur wearing multiple hats, I discussed how I manage my time across various projects and businesses, my transition from running a cloud bookkeeping firm to focusing on product marketing, and my approach to content creation and leveraging technology.

ChatGPT scores 90% on debits & credits test

ChatGPT scored 18 out of 20 on the Debits & Credits test. The score to show an intuitive understanding is 15 out of 20.

Rethinking the CPA 150-hour requirement: There must be a change

If we want a robust, dynamic, and inclusive accounting profession, we need to remove costly and unnecessary barriers to becoming a CPA. In my latest article on the Firm of the Future blog, I delve into the challenges associated with the CPA 150-hour education requirement.

Pro Wrestling, Anime, and Financial Modeling with Ariel Menche

I had the pleasure of speaking with Ariel Menche, Strategic Finance Advisor at Raftel Strategy, on my latest podcast episode. With a fascinating blend of experiences ranging from WWE to anime and finance, Ariel brings a unique perspective to the table.

Don't make this mistake with ChatGPT

A lawyer used ChatGPT to write a 10-page brief that he submitted to a federal court. Just one problem — the cases cited were fake!

Join me for "Why Virtual Accounting Firms Fail & How to Build One That Lasts"

Nayo Carter-Gray is joining me in this next episode of Grow & Scale, a series by Financial Cents — I'll be asking for her take on why virtual accounting firms fail and how to build one that lasts.

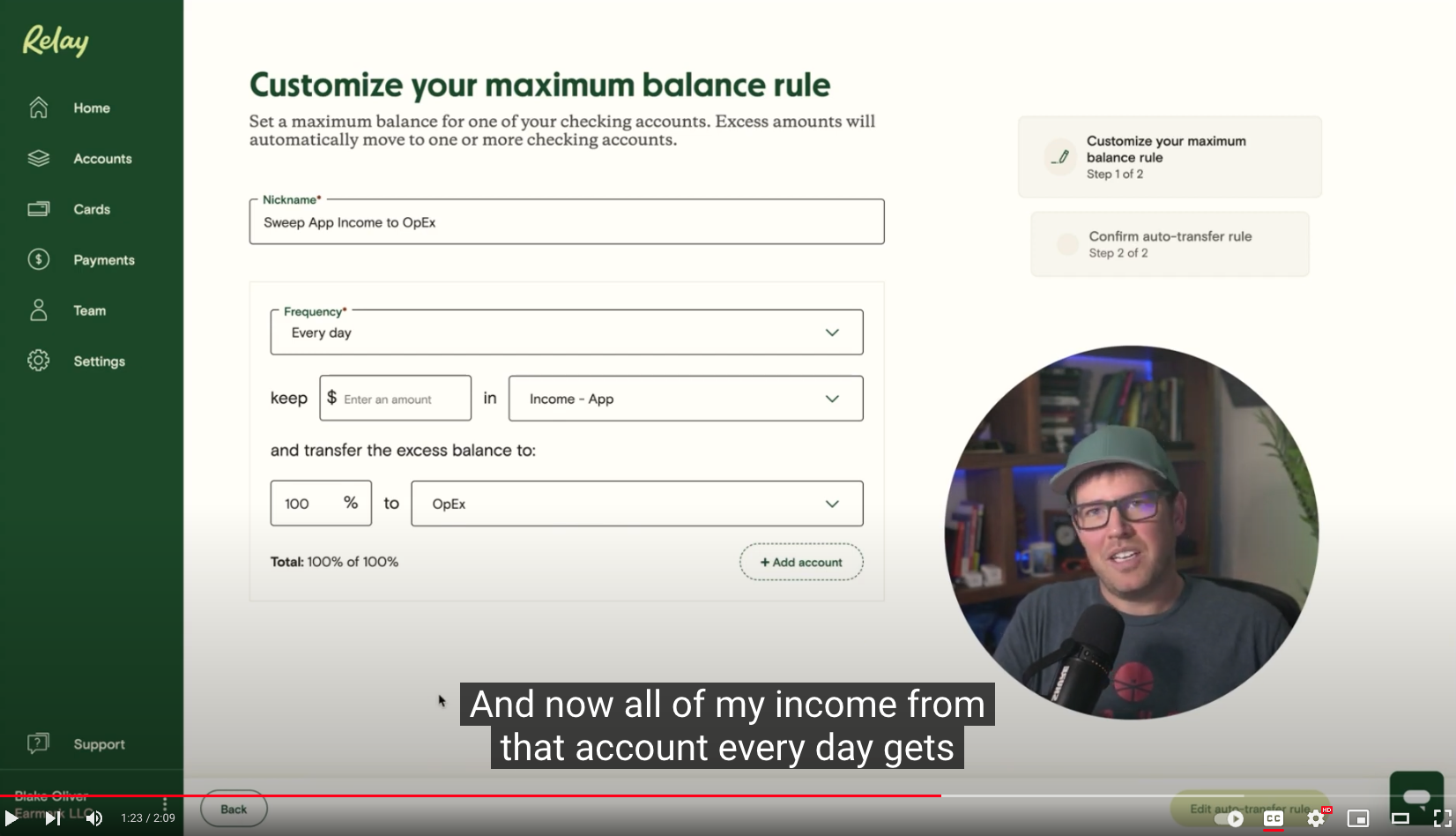

Use Relay to Auto-Transfer Income to Your Operating Checking Account Every Day

This new Relay feature is my favorite yet! Now you can set up auto-transfer rules to automatically transfer money from one account to another (or multiple). I'm using it to sweep money from my income accounts into my operating account on a nightly basis. Watch the video to learn how to set it up.

Sharing the Wealth: Is Asking Partners to Increase Salaries the Answer to the Accounting Talent Shortage?

Gary Bolinger writes in Accounting Today that "the 150-hour rule is not the problem" and recommends that a solution to the talent shortage is "partners need to share the wealth" by increasing starting salaries.

Distorted Images: How Accounting Rules Allow Banks to Hide the True State of Their Finances

The accounting treatment of mortgage-backed securities (MBS) on bank balance sheets can distort the true financial health of banks and mislead investors. The current practice of classifying MBS as "hold-to-maturity" investments enables banks to manage earnings and hide their financial position. Therefore, the Financial Accounting Standards Board (FASB) should prioritize transparency and accountability by reevaluating this practice, which can promote a more stable financial system.