Thanks, Meryl Johnston, for having me on the Lifestyle Accountant Show! As an entrepreneur wearing multiple hats, I discussed how I manage my time across various projects and businesses, my transition from running a cloud bookkeeping firm to focusing on product marketing, and my approach to content creation and leveraging technology.

ChatGPT scores 90% on debits & credits test

Rethinking the CPA 150-hour requirement: There must be a change

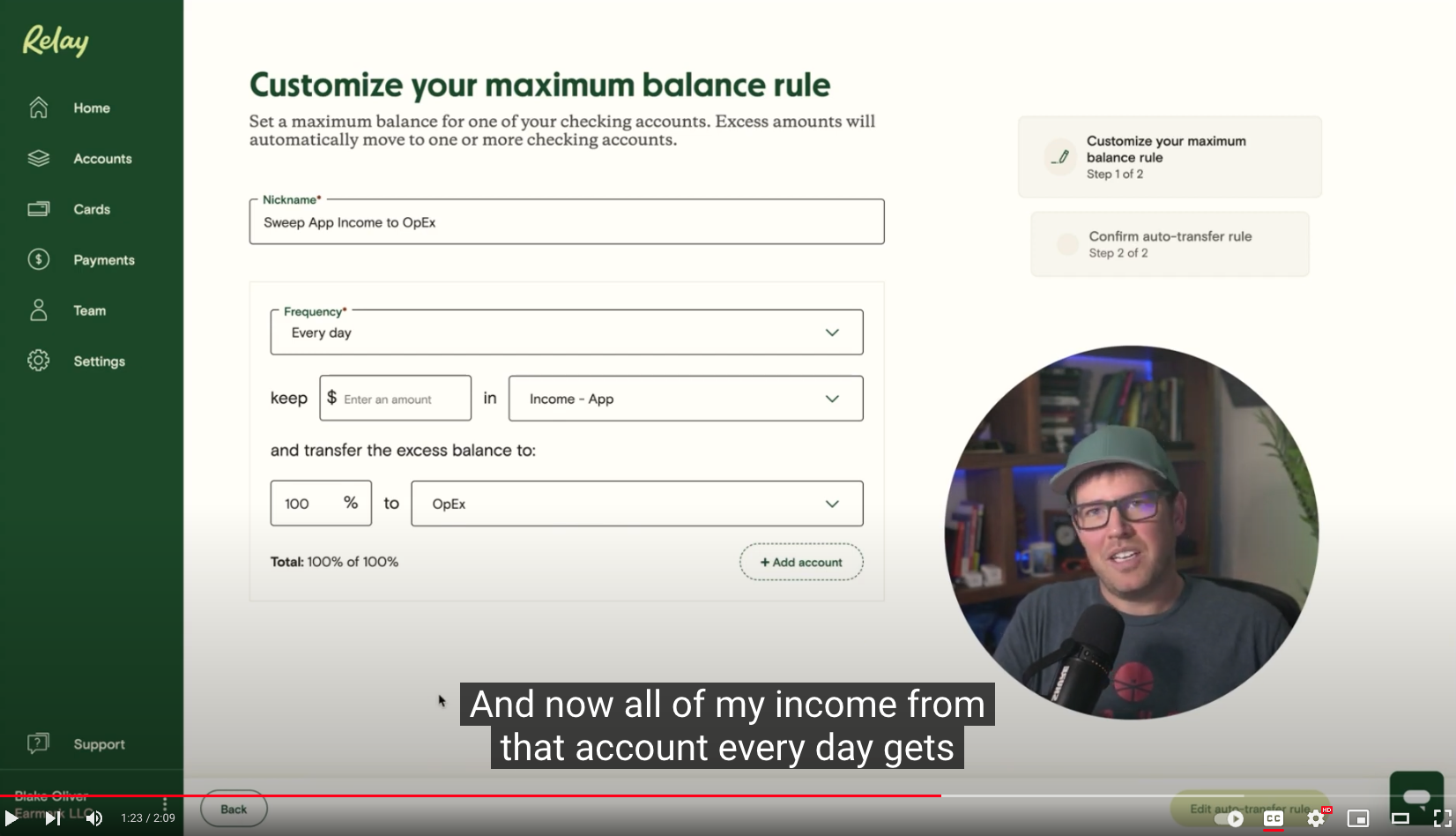

Use Relay to Auto-Transfer Income to Your Operating Checking Account Every Day

Sharing the Wealth: Is Asking Partners to Increase Salaries the Answer to the Accounting Talent Shortage?

Distorted Images: How Accounting Rules Allow Banks to Hide the True State of Their Finances

The accounting treatment of mortgage-backed securities (MBS) on bank balance sheets can distort the true financial health of banks and mislead investors. The current practice of classifying MBS as "hold-to-maturity" investments enables banks to manage earnings and hide their financial position. Therefore, the Financial Accounting Standards Board (FASB) should prioritize transparency and accountability by reevaluating this practice, which can promote a more stable financial system.

A CPA's Perspective on the SVB Collapse: Rethinking Financial Protection and Reporting for Investors

Get a CPA's perspective on how to prevent another startup bank run, as we dive into the complexities of FDIC protection, financial statements, and investor risk assessment in the world of startups. Learn why increased regulation may not be the answer and how a transformed financial reporting system could empower investors. Let's reimagine investor protection and the future of accounting.

Build A Focused Firm Finale: "Let’s Talk Practice Management"

Hector Garcia, CPA, will summarize the key takeaways from all seven episode of this series. Discover the most important things accounting firm owners need to know about positioning, the business model, technology, sales process & onboarding, value pricing & offering guarantees, attracting & retaining talent, and innovation. Join us live to ask your questions and get answers from Hector.